WHAT MAKES US DIFFERENT?

ARC Risk and Compliance is a consulting company comprised of a team of AML Specialists completely focused on anti-money laundering (AML) compliance and the technologies used to support compliance programs. We have hired, trained and dedicated our team to AML compliance and regulations. Our team is comprised of former regulators, BSA offificers, technology offificers, and project managers. Since our specialty is AML, we can assist fifinancial institutions, credit unions, money service businesses, insurance companies, and broker-dealers through a variety of services.

Exclusively AML-Specialized Company

Dedicated team in AML compliance and software supporting AML programs, including:

BSA/Transaction Monitoring, OFAC/ Sanctions Screening, KYC/CDD/EDD and FinCEN 314(a)

Bridge the Gap Between AML Compliance and Technology

Understand how technology works, it’s limitations, ways we can work through it, compliance regulations and guidance, and why it’s important to an AML program

Supported by a Tri-Ally Approach

Each project team is incorporated with a dedicated project manager, a compliance expert, and a technical expert for a more thorough work product and experience

OUR SERVICES

AML MODEL VALIDATION

According to the guidance provided by the Office of the Comptroller of the Currency (OCC), Federal Deposit Insurance Corporation (FDIC), National Credit Union Administration (NCUA), and The Federal Reserve System on model risk management, “the use of models invariably presents risk” and the risk presents itself typically in two aspects: there may be fundamental errors or it’s being used incorrectly. It is for this reason, how a model validation is conducted is what matters the most. Valuable model validations are independent, completed by experts who understand the use of a model, and review all related parts of the model. More specifically, an anti-money laundering model is not the same as a credit risk model.

AML GAP ANALYSIS

Our AML Gap Analysis is a methodical and detailed examination of your institution’s BSA policies and procedures in line with the most current FFIEC BSA/AML Examination Manual. We begin with a review of the institution’s AML Risk Assessment to understand the make-up of the customer base, the geographic reach of the institution and its customers, and the products and services offered, in order to construct a review plan which mirrors the composition of the customers, geography and products and Services. In addition to the policies, procedures, and processes of your BSA/AML compliance program

LOOK-BACK SERVICES

A look-back sounds simple, or complex, depending on your perspective. Simply put, it’s the process of reviewing a set of transactions over a defined period to determine if any suspicious activity occurred, which went previously undetected. Through our highly experienced data scientists and the AML depth of knowledge, our compliance experts have been able to employ efficiency, time, and money-saving measures.

DATA MINING: ANALYSIS & CORRECTION

Our remediation services focus on assisting you with challenges you face. Sometimes that means correcting the data, sometimes that means conducting a mandated look-back, but other times it simply means remediating issues found in an exam; either way we can help you with correcting these issues with confidence and employing the latest cost-saving methods.

REGULATORY REMEDIATION SERVICES

ARC Risk and Compliance has a proven track record of supporting our clients through a number of remediation efforts. We work with the institutions to provide guidance consistent with regulatory expectation and a clear plan of action. The process includes management reporting, remediation items tracking, and consultation on resolution. We will develop a plan to achieve the requirements outlined in a FI’s consent order or voluntary project.

NYS DFS 504 PRE-CERTIFICATION SERVICE

All state chartered or licensed financial institutions that are regulated by the Department of Financial Services (DFS) are mandated to certify that their anti-money laundering program meets the requirements for their transaction monitoring, sanctions filtering, training, and model governance. While this formalized what many institutions have been doing, this increased the pressure to ensure it was being done so thoroughly. As an additional checkpoint for compliance officers, these institutions have to certify with DFS that these requirements have been met, and they must do so annually.

Business Requirements Documentation

Our approach is to work with the business (compliance) and IT departments to bridge the gap between the two. Our extensive experience in developing, implementing/upgrading, false positive reduction, and independent verification and validation/model validation of a broad range of these systems provides us a unique skill set in developing business requirements documentation (BRD) specifically for AML/BSA, OFAC, CDD/KYC, and FinCEN 314(a) programs.

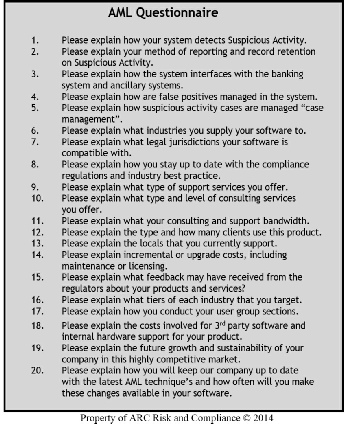

RFI/RFP CREATION & PROCESS SERVICES

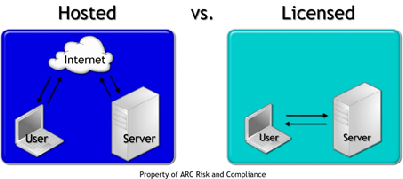

With more than a decade of experience in the AML industry, we have educated ourselves on the major software vendors, their features and functionalities. We know the programs, and after we review your business requirements documentation (BRD) and functional requirements documentation (FRD), we’ll know what questions you should be asking. An effective RFI/RFP process should include a number of vendors, with a number of possibilities, all with your peace of mind as the goal in the end.

CUSTOMIZE USER WORKFLOWS

Whether upgrading, migrating, or implementing a new AML system, our extensive experience in the implementation, configuration, and training, on a broad range of AML systems, can be leveraged to lead or assist your team in bringing a successful project to fruition.

TESTING SERVICES

Having been in the AML industry for nearly two decades, we saw that there was a need for change in the way testing was done in the industry. With that in mind, we set out to innovate our testing methodology. Our modernized defined, regimented testing process ensures success by documenting and supporting various types of specialized anti-money laundering (AML) technology testing

AML RISK ASSESSMENT

According to the FFIEC manual, you should reassess your FI’s current BSA/AML risks every 12 to 18 months. While it is not necessary for this to be done outside of the bank; it is valuable to periodically get an independent perspective. This outsider’s view can be refreshing and helps to further demonstrate your willingness to ensure your FI is compliant. With the push to innovate our AML programs, we have seen risk assessments evolve over the last 15 years moving away from a qualitative approach toward a detailed, quantitative methodology.

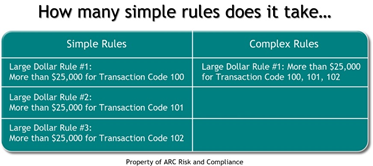

RULES/RISK RATING/ PROFILING: STATISTICAL DATA ANALYSIS

These services assist you in reviewing your data to statistically demonstrate your risk, evaluating and improving your thresholds to provide better quality alerts, and provide you supplemental business intelligence to support AML compliance decisions.

SOFTWARE TUNING AND OPTIMIZATION

The purposes of conducting a software tuning optimization might be to balance the case analyst workload on a transaction monitoring system or make adjustments based on your customers, products or services, or the geography in which you serve has changed. While both of those are true, improperly setting up the software can also affect your alert/case volume, and simply may be inaccurate based on your risk assessment and program requirements.

AML PROGRAM OUTSOURCE

Financial institutions and credit unions are tasked with monitoring financial transactions, screening their transactions and customers/members for sanction restrictions, and really knowing who their customer is. These tasks come with regulatory burdens, financial burdens, and administrative burdens. As a means to minimize this burden on the U.S. financial system, FinCEN released an interagency statement encouraging financial institutions to consider ways of sharing BSA-necessary resources.

AML STAFF AUGMENTATION

ARC Risk and Compliance is the leading anti-money laundering (AML) consulting company with an extensive network of AML professionals. With each engagement, we will provide an individual or team, on-site or off-site, to augment your institution’s needs.

CUSTOM SOFTWARE DEVELOPMENT

As technology experts in AML solutions, we have the depth of knowledge to assist your institution in developing custom code to optimize your existing software, or build a proprietary system designed to fit your institutions needs. We have the technical skill set to build custom interfaces, reconciliations, rules/scenarios, reports, and other solutions, as requested.

AML CYBERSECURITY

As the world continues to evolve, criminals learn new ways to thwart detection and new ways to attack the financial system as a whole. These new methods include digital attacks on a bank’s security system, accessing their data, and various other methods, such as spoofing, hacking, etc. To help financial institutions assess their risks, we have a number of services that we can help you with: