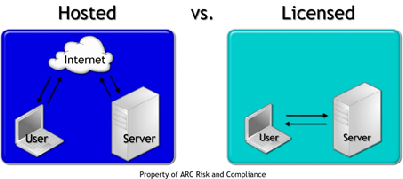

All state chartered or licensed financial institutions that are regulated by the Department of Financial Services (DFS) are mandated to certify that their anti-money laundering program meets the requirements for their transaction monitoring, sanctions filtering, training, and model governance. While this formalized what many institutions have been doing, this increased the pressure to ensure it was being done so thoroughly. As an additional checkpoint for compliance officers, these institutions have to certify with DFS that these requirements have been met, and they must do so annually.

By utilizing the Tri-Ally approach, which we provide as part of all of our services, and even more so for a DFS regulated institution, you will receive a team of experts who can present you with a a confidence report that your program is meeting or missing those requirements. This independent set of experts is made up of technical wizards, data scientists, and compliance experts with knowledge and experience to support their position.

What You Get with ARC:

- A 504-level review of your transaction monitoring and sanctions filtering programs, with specific focus on heightened areas of scrutiny.

- A gap analysis of your AML program by identifying those program areas that excel and those that fall short.

- A report that can substantiate the certification that your corporate officers commit to by demonstrating that your financial institution clearly understands their responsibilities and is ready to meet them.